Understanding Marketing Strategies and 6 Types

All You Need to Know About Grace Periods for Borrowers

Understanding Predatory Lending Laws

Understanding HELOCs and Home Equity Loans

Malpractice insurance protects workers from losing money because of carelessness. Understand the types, benefits, and downsides of selecting the right provider.

The asset turnover ratio measures how efficiently a company utilizes its assets to generate revenue. Learn more about it, along with its formula.

Are you curious about credit scores? Let’s talk about what they are and how often your credit score gets updated for financial well-being

Countries that agree on trade terms create free trade agreements. These agreements set tariffs and levies on imports and exports. Read more.

Exports are goods and services produced in one country and sold to another. Countries benefit from it. Learn its process, benefits, and drawbacks

This step-by-step guide lets you open a business bank account online. Quickly and easily create a secure business banking account in minutes.

Get secure and efficient fee-free banking for freelancers and small businesses with Lili. Enjoy easy access to your finances and take control of your money.

Learn about payroll taxes and how they are collected, including information on employee and employer payments and their calculations.

Modular homes are an increasingly popular option for those looking to purchase a home, but there are potential risks that need to be considered. This article outlines the pros and cons of modular homes, exploring topics such as efficiency and cost-effectiveness in construction, environmentally friendly features, and the affordability and accessibility of homeownership

Get up to speed on the new IRS mileage rate for 2023 with this comprehensive guide. Understand how it affects your taxes and learn tips for tracking and optimizing your deductions.

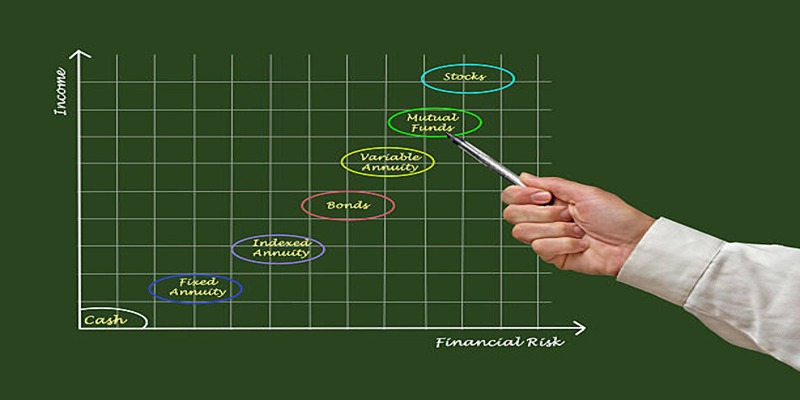

Wealth Management and Its Necessity" is an all-encompassing guide that dives deep into the realm of wealth management. It explains the concept, the wide range of services offered by wealth managers, and how these professionals can help you achieve your financial goals

This article will explain different types of interest income, how to report it on your tax return, strategies to minimize tax liability, and what to do if you owe unpaid taxes from previous years’ interest earnings.

Use a nondeductible IRA to invest. Contributions to an IRA that aren't tax-deductible are given out after taxes. IRAs that don't reduce your taxes have both pros and cons.

Aidvantage, a loan servicer, handles the management of federal student loans.

Making And Keeping Your New Year's Resolutions

RefiJet Auto Loans: An Overview

Explaining: How Free and No-Fee Bank Accounts Help Save You Money

All About Texas First-Time Home Buyer Programs

Best 5 Credit Unions and Military Banks

What Is a Hard Money Loan?

Mortgage Life Insurance and What Coverage Do It Provide

You Can Cancel Your Authorized User Status On A Credit Card

Methods for Obtaining a Pell Grant

Mark-To-Market Losses