For busy small business owners, the convenience of setting up a business bank account online can be a relief. These online accounts offer numerous benefits. They secure a place for your business earnings, restrict your personal and business funds, and streamline the management of business-related tax deductions.

Gone are the days when setting up a business account required a trip to a bank branch. Modern banking allows you to open a business checking account online from your office or living room.

Choosing the best business bank accounts requires extensive online research, and one must find the best business account bank for your needs. It is essential to remember each account has benefits and features, so choose one that fits your business goals.

Steps For Opening a Business Bank Account Online

The below steps will give you a clear insight and a step-by-step guide for making an online business bank account.

Step 1: Starting the Process

Visit your chosen bank's website to open a business account online. This is essential to choosing the best business bank. Search the website for business checking account opening instructions. This simple first step lets you select one of the best business bank accounts.

Step 2: Choosing the Right Account

To choose the proper business bank account, carefully review the available options. Each account has different features and benefits, so choose one that suits your business. This choice will affect your financial future, so make it carefully.

Step 3: Preparing for the Account Opening

Before proceeding, ensure you have the necessary funds for the minimum opening deposit. This requirement varies between banks and accounts, so it's essential to be prepared. Knowing the exact amount needed and having it ready will streamline the process.

Step 4: Gathering Necessary Documentation

It's essential to gather all required business documents. This varies by business structure—LLC, partnership, or sole proprietorship. LLC articles of organization and tax ID numbers like EINs are standard documents. Personal Social Security numbers may be needed. Business owners usually need personal identification to prove their identity. Your business's banking legitimacy depends on this step.

Step 5: Completing the Process

The final step involves electronically signing necessary authorizations, including giving the bank permission to conduct a credit check. This is a standard procedure in opening any business bank account and ensures both parties are protected.

Factors To Consider Before Opening A Business Bank Account

1. Digital Banking Features

When selecting the best business bank accounts, prioritize the convenience of managing finances remotely. Look for accounts that offer essential features such as mobile check deposit, online bill payment, and an intuitive mobile application.

These tools are vital for efficient financial management, allowing you to handle banking tasks from your office or while on the move. Ensure the account aligns with your day-to-day banking needs for a seamless business operation.

2. Business Banking Services

The best bank for business accounts often provides additional services for your company's growth. These include small business loans, cash flow management solutions, and tools for analyzing your business revenue and forecasting sales.

These services can be crucial for strategic planning and financial stability. Opt for a bank that offers a comprehensive suite of services tailored to your business needs, enhancing your financial management and growth potential.

These tools help you assess your company's finances and make decisions. Advanced services like data analytics and revenue projections provide deep financial insights into your business. This level of support is essential for any growing business, making bank selection crucial.

3. Ease of Integration

Businesses using PayPal, QuickBooks, Shopify, Stripe, or Venmo need a company checking account that integrates with these platforms.

This integration streamlines payment processing and financial tracking, making updating records easier. Choose an account that integrates with your business's digital tools.

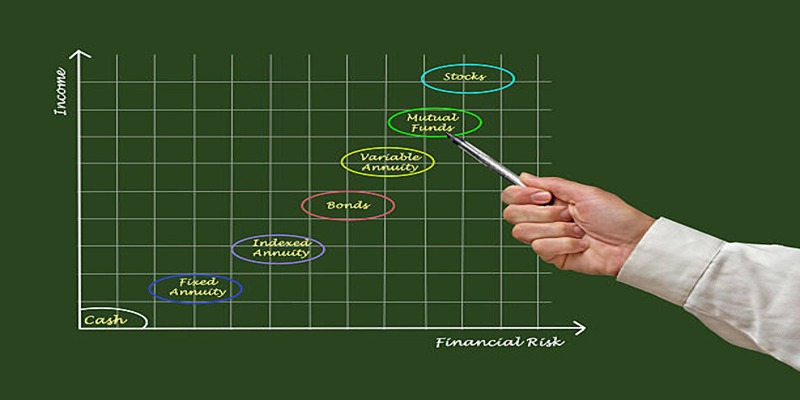

4. Interest Rates for Deposit Accounts

While some business checking accounts offer interest, the annual percentage yield (APY) may not always be competitive compared to top online savings accounts.

It is essential to assess the interest rates and determine if they meet your financial goals. Even if the interest is a bonus, ensure the account's other features align with your business's banking requirements.

5. Service Fees

Service fees, including monthly charges, ATM fees, and costs for wire transfers, are critical factors when choosing a business bank account.

These fees can add up, impacting your overall financial health. Scrutinize all potential fees associated with the account to avoid surprises and ensure it's cost-effective for your business's financial transactions.

6. Branch Banking and ATM Access

Consider the physical accessibility of banks and ATMs, mainly if your business deals with cash transactions or requires in-person banking services.

Ensure the bank you choose offers convenient branch and ATM locations. This is vital best bank for business account businesses that need to deposit or withdraw cash frequently or prefer face-to-face interactions for certain banking services.

7. Monthly Transaction Limits

Be aware of any transaction limits imposed by business bank accounts. Some accounts may restrict the number of free transactions per month and charge fees for additional transactions.

Understanding your business's typical monthly transaction volume is essential. Choose an account that accommodates your transaction needs without incurring excessive costs. This consideration is crucial for managing your business finances effectively.

8. Separating Business and Personal Finances

A business checking account is brilliant for any entrepreneur. It's crucial for separating personal and business finances. This separation is essential for legal and organizational reasons.

Having separate accounts protects your assets if your business is sued. It simplifies financial management, letting you grow your company. Choosing the best business account bank ensures you have the correct support for this crucial business aspect.

9. Tracking Tax Deductions

One of the key benefits of a business checking account is the ease of tracking tax-deductible expenses. Whether paying suppliers, equipment purchases, or inventory costs, a dedicated account simplifies record-keeping. This organization is invaluable when it's time to file taxes, as it helps ensure you don't miss out on any deductions.

Additionally, using the best business bank accounts can provide tools that make monitoring these expenses even more efficient. Accurate and easy tracking of business expenses not only aids in tax filing but also provides a clear picture of your financial health.