Malpractice insurance protects professionals from financial losses from carelessness or poor service. Malpractice insurance protects finances and customer trust. Its wide range of applications emphasizes its relevance in risk management techniques for business and financial professionals. It is especially important for high-risk professionals like:

- Law attorneys

- Accountants

- Physicians

- Health-care providers

Incident-based and claims-made insurance cover occurrences and claims submitted during the policy term. Medical malpractice insurance helps professionals handle legal issues without losing their assets or reputation. It's a safety net that lets professionals focus on their practice while minimizing liabilities and legal expenditures, making their work more resilient.

Importance of Malpractice Insurance

Doctors and nurses are often in situations where mistakes could hurt people. Malpractice insurance saves them from claims for medical malpractice. It pays for court fees and verdicts. Also, doctors can focus on caring for their patients without considering losing money.

Lawyers and attorneys need liability insurance. Lawyers have malpractice insurance attorney to protect them from claims of professional carelessness and mistakes in representation. This policy is important for the financial health of law firms and for protecting lawyers from court proceedings. Defending yourself in court and settling fraud claims can cost a lot. Professionals can avoid losing all their money and keep working if they have malpractice insurance. Also, malpractice insurance makes customers more likely to trust you. Clients and patients can trust pros who have taken steps to reduce risks at work.

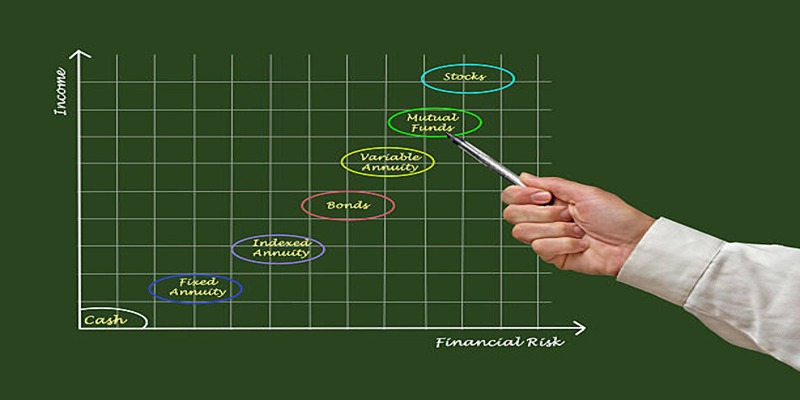

Types of Malpractice Insurance

Professionals can get malpractice insurance in many ways. The simplest is buying private insurer insurance for individuals or groups. These policies are tailored to individual or group practitioners. Some professionals may not require malpractice insurance. Under federal law, federal health facility workers are immune from civil claims, providing special protection. State and municipal governments facilitate malpractice insurance when necessary due to special conditions or legislative restrictions. Professionals seeking malpractice insurance must understand policy types. The main categories include:

Claims-Made Policy

Claims-made malpractice insurance must be active at the time of the malpractice incident and when the lawsuit is filed. For coverage, the insurance must be in effect throughout these essential times. Synchronizing the claimed malpractice with the policy's active state ensures the insurer covers the claim. Time-sensitive claims-made plans require continuous and uninterrupted coverage to resolve possible claims, emphasizing the necessity of maintaining an active policy status throughout the process.

Occurrence Policies

Occurrence policies cover more. Their coverage includes therapies received while the policy was valid, regardless of its status. Claims from occurrences within the policy's active term are covered after expiration. This provides coverage for claims based on when the incident occurred, making it attractive for professionals wanting full protection. Due to the policy's extended coverage, claims from occurrences that happened throughout the policy's active period can be handled, making occurrence-based malpractice insurance flexible and inclusive.

Downsides of Malpractice Insurance

Even though it's necessary, malpractice insurance has some problems that come with it. One big problem is that insurance rates could go up, which would hurt high-risk workers who have had a lot of cases in the past. Individual practitioners and smaller groups may not be able to handle this extra financial stress well, which can affect their total financial stability. Also, malpractice claims can hurt a professional's image for a long time. Even if the practitioner is found not guilty, the accusations can hurt their reputation, affecting patient trust, transfer rates, and their general professional standing. These problems show how complicated malpractice insurance is. The benefits of protection must be carefully weighed against the possible financial and social dangers.

Malpractice allegations stress and emotionally drain professionals. The uncertainties and malpractice insurance cost repercussions of legal proceedings can increase stress and harm mental health. This stress might worsen patient care and practitioner job satisfaction. These drawbacks demonstrate malpractice insurance's complexity, requiring a delicate balance between its protective advantages and possible risks to a professional's financial, reputation, and emotional well-being.

Cost of Malpractice Insurance

Professionals must carefully consider the malpractice insurance cost, which depends on their job, location, and skill level, among other things. Surgery and other high-risk fields have a higher chance of claims, so they need more expensive coverage. The fact that costs vary shows how important it is for professionals to look at their risk factors and their business needs to ensure they have enough financial safety. Different areas and regions have different claim risks because of their complexity. This is why practitioners must make smart choices to get coverage that fits their needs and lowers the possible financial loads from malpractice claims.

Selecting Professional Liability Insurance

Professionals wanting comprehensive malpractice insurance must choose the correct supplier. Practitioners should weigh various criteria while comparing insurers.

Check the professional reputations of insurance companies first. Find companies that have a good name for taking care of cases quickly. Check the insurance company's finances to make sure it can pay claims. Then, look at the policy's specifics. Check out the extra perks, policy limits, and things that aren't covered. Professionals should look for insurance that covers the risks of their job. Some types of insurance may cover certain dangers or changes in the business world.

Additionally, customer evaluations are essential for understanding other professionals' insurance provider experiences. Ask about claims convenience, customer service, and coverage satisfaction. Finally, compare premiums among suppliers. While malpractice insurance cost are important, practitioners should prefer complete coverage that protects their interests. Making an informed selection based on price and coverage helps practitioners meet their professional goals and risk tolerance. Professionals may easily pick an insurance provider that balances dependability, coverage, and assistance by carefully analyzing these characteristics.

Professionals must act quickly and strategically during malpractice insurance claims. First, notify the insurer of a malpractice claim. This is crucial since delays might hinder the insurer's claim response. Professionals should immediately collect and provide medical, communication, and other relevant records. Maintaining open contact with the insurance company is crucial. Experts can manage the claim's intricacies with the insurer's claims staff to ensure a thorough and documented defense. Timely reporting streamlines the claims procedure and improves settlement odds, protecting the practitioner's image and finances.